- Apartments from 257,599 AED

- Townhouses from 596,284 AED

- Villas from 936,561 AED

- Penthouses from 1,055,170 AED

- Studios from 257,599 AED

- All off-plan projects

Apartments

No itemsTownhouses

No itemsVillas

No itemsPenthouses

No itemsStudios

No itemsAll off-plan projects

No itemsCommunities

-

Сommunities 88

SHOW All

-

Off-plan

-

from 257,599 AEDShow all 740 projects

-

Lazord, Dubai

-

77S Tower, Dubai

-

La Vue, Dubai

-

La Clé, Dubai

-

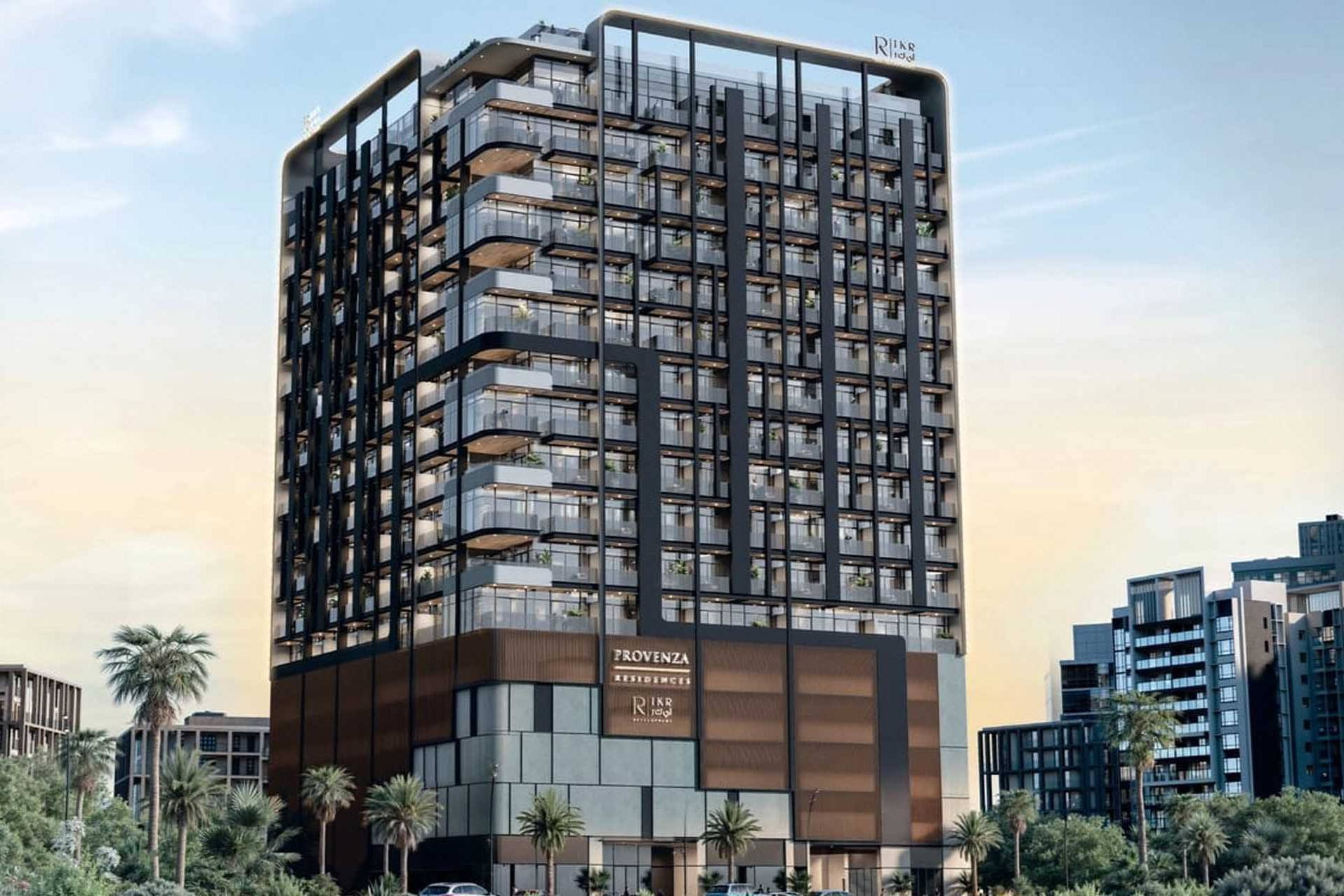

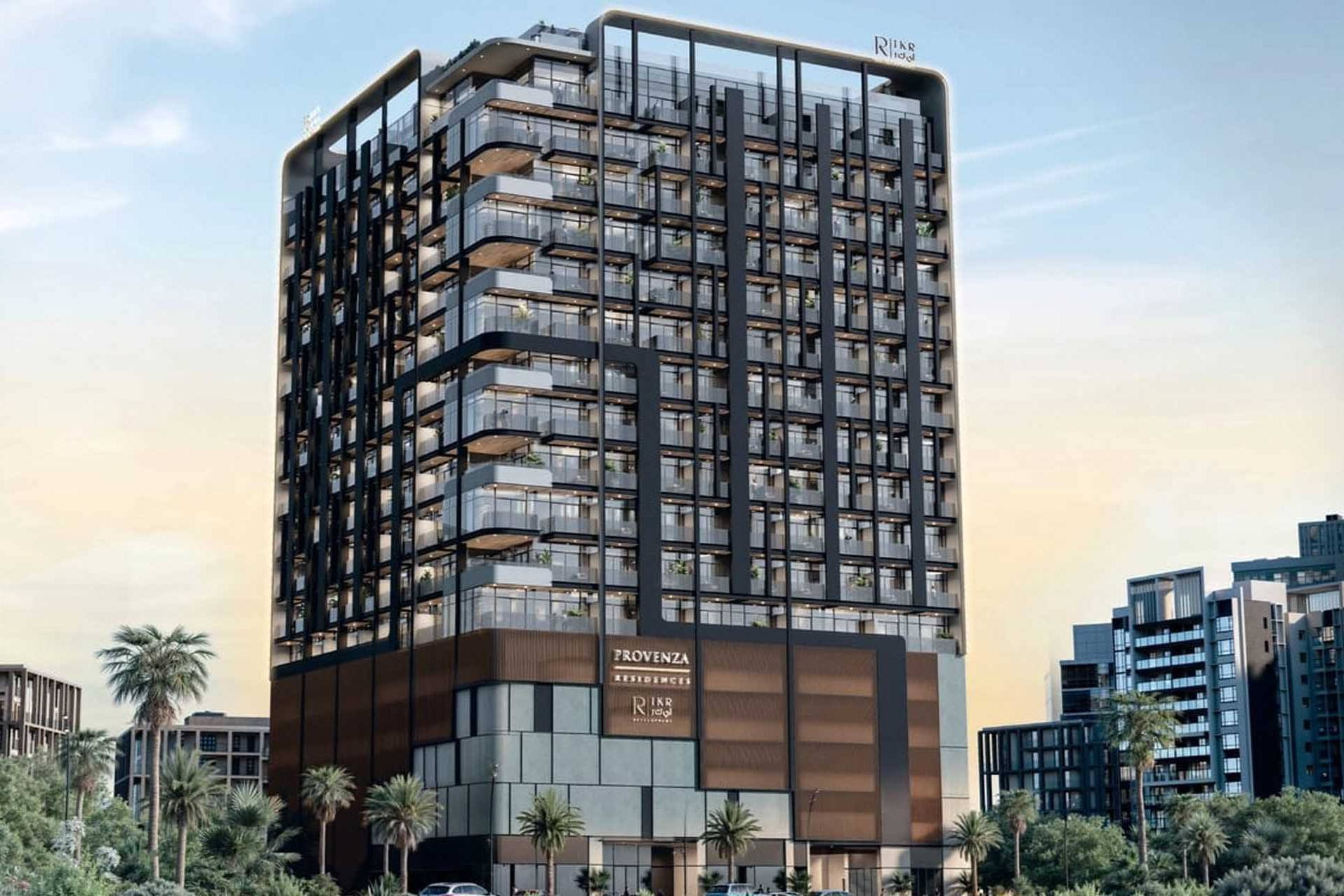

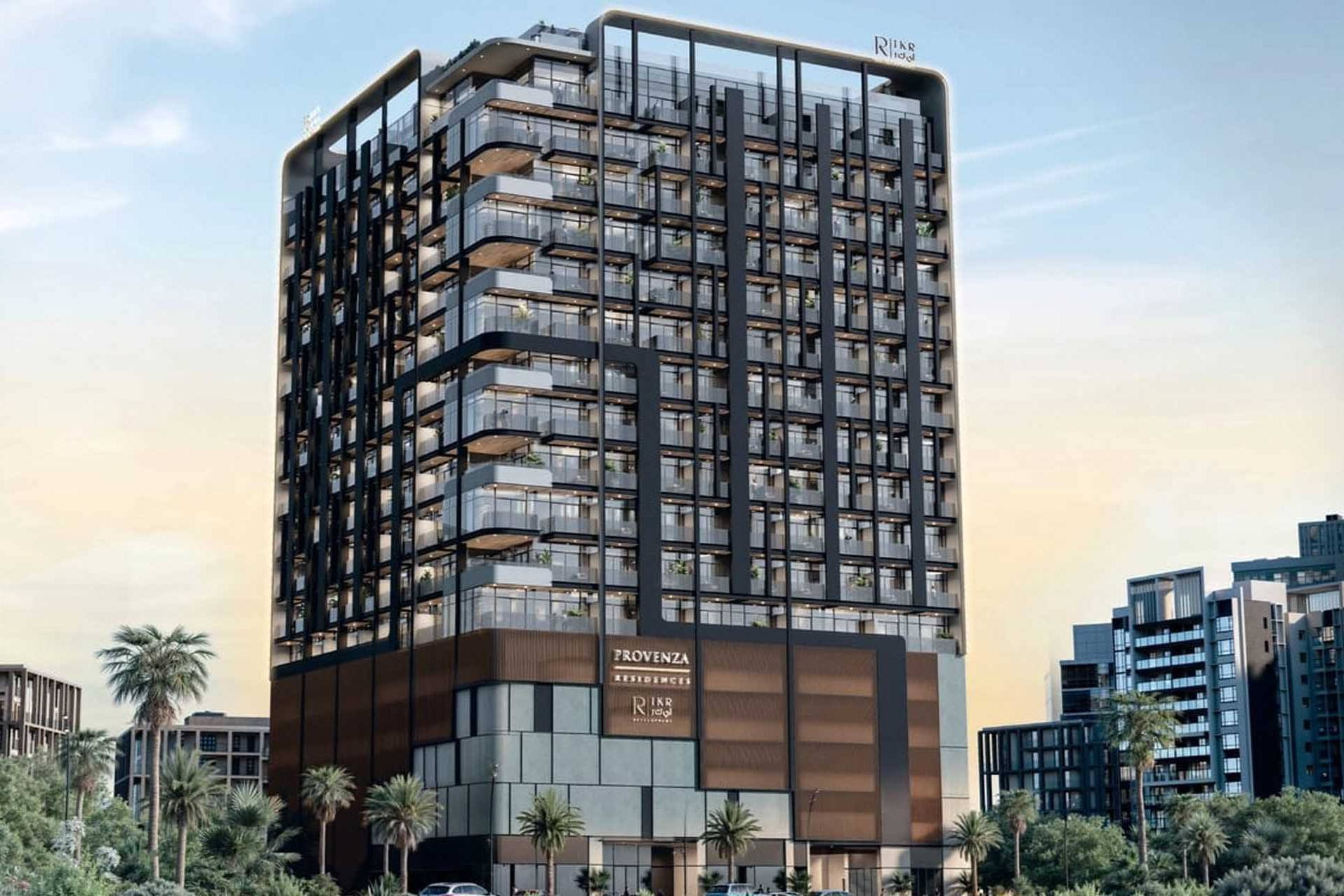

Provenza Residences, Dubai

-

Yachtside Marina Residences, Umm Al Quwain

-

Alton, Dubai

- Projects in total 740 SHOW All

-

-

from 596,284 AEDShow all 120 projects

-

Altan, Dubai

-

Shoaq Residences, Dubai

-

Albero, Dubai

-

Masaar 2 Narenj, Sharjah

-

Masaar 2 Melia, Sharjah

-

Masaar 2 Anber, Sharjah

-

Masaar 2 Coral, Sharjah

- Projects in total 120 SHOW All

-

-

from 936,561 AEDShow all 139 projects

-

Waldorf Astoria Residences by Nabni

Waldorf Astoria Residences by Nabni, Dubai

-

Montura, Dubai

-

Chevalia Estate, Dubai

-

Selora Residences, Dubai

-

Anantara Mina, Ras Al Khaimah

-

Rivera, Dubai

-

Atelis, Dubai

- Projects in total 139 SHOW All

-

-

from 1,055,170 AEDShow all 90 projects

-

77S Tower, Dubai

-

Arya Residences, Dubai

-

Voxa Pantheon, Dubai

-

Shoaq Residences, Dubai

-

Treppan Living, Dubai

-

Brabus Island, Abu Dhabi

-

Trump International Hotel & Tower Dubai

Trump International Hotel & Tower Dubai, Dubai

- Projects in total 90 SHOW All

-

-

from 257,599 AEDShow all 261 projects

-

Lazord, Dubai

-

Cove Edition 5, Dubai

-

Provenza Residences, Dubai

-

Santorini Residences, Dubai

-

Arlington Park, Dubai

-

Arthouse Residences by Clédor, Ras Al Khaimah

-

Marquis Vista, Dubai

- Projects in total 261 SHOW All

-

-

-

Lazord, Dubai

-

Cove Edition 5, Dubai

-

77S Tower, Dubai

-

La Vue, Dubai

-

La Clé, Dubai

-

Provenza Residences, Dubai

-

Yachtside Marina Residences, Umm Al Quwain

- Projects in total 1350 SHOW All

-

-

-

Communities

-

Properties

-

Apartments from 330,320 AEDShow all 578 projects

-

Townhouses from 530,000 AEDShow all 83 projects

-

Villas from 800,828 AEDShow all 107 projects

-

Penthouses from 562,939 AEDShow all 61 projects

-

Studios from 259,469 AEDShow all 174 projects

-

All properties from 259,469 AEDShow all 1003 projects

-